he Fifth National Economic Development Plan (2011-15) stipulated that Iran should have become the first regional hub in cargo transportation and the second in passenger transport.

This never happened though, as years of economic sanctions throughout the plan’s timespan prevented the Islamic Republic from keeping its air fleet up to date.

Now with the finalization of the new jet order with Boeing and an Airbus contract around the corner, the country seems ready to claim the regional transport share it lost to its neighbors over the sanction years.

Minister of Roads and Urban Development Abbas Akhoundi has on several occasions expressed dissatisfaction over the damage suffered by the country over its waning competitive edge vis-à-vis the regional countries.

“Iranians buy up to $4 billion worth of plane tickets from foreign airlines every year,” he said in early July.

“Due to the dismal state of Iran’s air fleet, we have not been able to exploit this potential,” he said, referring to Iran’s strategic location in the region.

The handful of Iranian airlines own an aggregate of 273 aircraft with an average age of 23.74 years, including 266 passenger and seven cargo planes, only 163 of which are currently operational, according to the Ministry of Roads and Urban Development.

The average age of the airlines’ operational feel stands at 22.9 years.

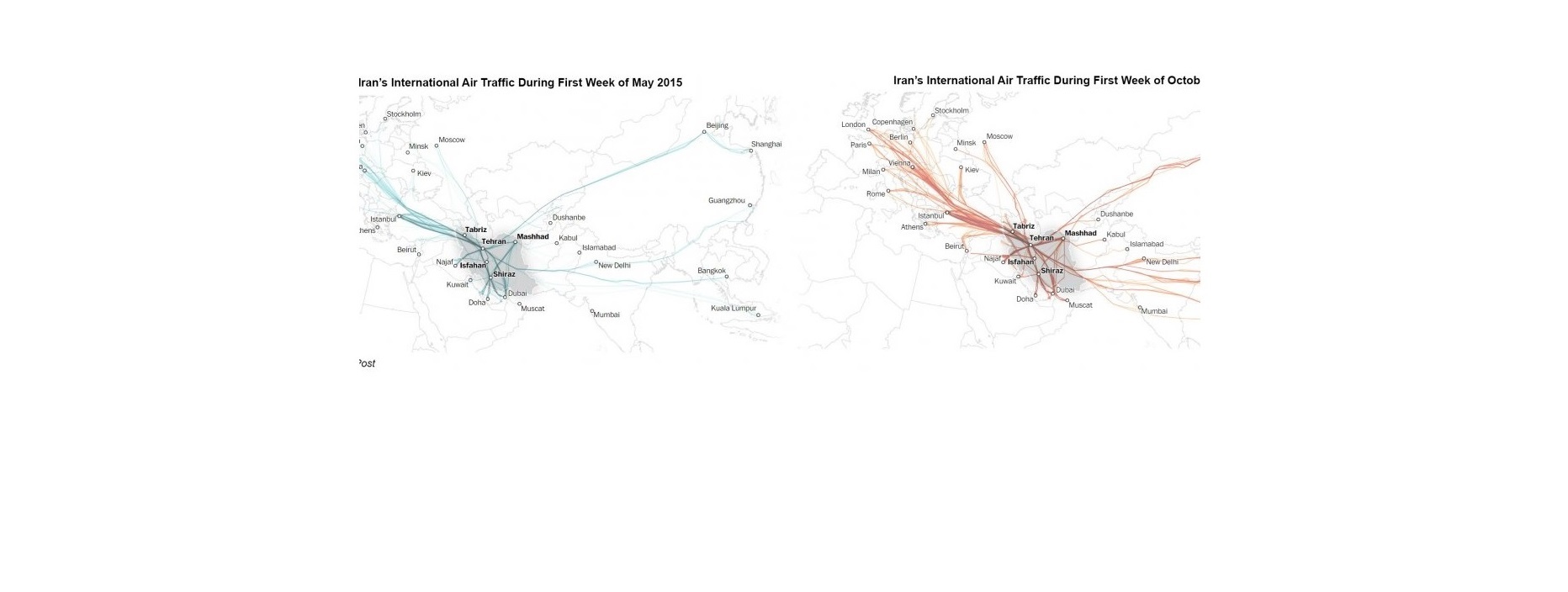

Iran’s dilapidated fleet has lagged behind regional competition, much to the advantage of airlines like UAE’s Emirates and Turkish airlines.

“Our passengers are flown from Tehran to Dubai, whereby they are transported to other destinations across the world,” Akhoundi said back in July.

Potential Competitive Edge

Several attributes would give Tehran a potential competitive edge over its regional rivals. The capital’s high altitude and temperate climate provide clear technical benefits, while its location offers more direct routings on flights between Europe and southeast Asia.

A large, highly-skilled indigenous workforce also guarantees low labor costs.

The first step taken by Iran Air on the long road to taking advantage of this potential was to order new aircraft from major planemakers. The flag carrier currently operates 50 passenger planes whose average age exceeds 27 years.

Iran Air signed a final contract in Tehran on Sunday to purchase 80 passenger jets from American plane manufacturer Boeing. The $16.6 billion deal includes 50 of Boeing’s narrow-body 737max 8s, 15 wide-body 777-300ERs and 15 777-9s, which will be delivered to Iran Air over 10 years. Boeing will start delivering the planes from April 2018. Iran Air is also planning to lease 29 new Boeing aircraft.

The Boeing deal will add 5,000 seats to Iran’s fleet, “which is more than double the current capacity of the country’s active fleet,” Akhoundi said on the sidelines of the contract signing ceremony.

In the minister’s words, the deal was aimed at “reclaiming Iran’s share from regional and global air transportation”.

Representatives of Airbus arrived in Tehran on Sunday for talks aimed at finalizing a deal to sell more than 100 planes, just hours after Iran Air concluded the Boeing deal.

Akhoundi’s deputy Asghar Fakhrieh-Kashan said on Monday the Airbus agreement will be signed within a week.

Iran Air had signed a preliminary deal with the French planemaker soon after the sanctions imposed over Iran’s nuclear program were lifted in January, during the visit of President Hassan Rouhani to Paris.

Long Way to Go

Iran has a long way to go before its ambition of becoming a regional air transport hub is realized. With traffic of 6 million passengers a year, Tehran’s airport is dwarfed by Dubai’s 78 million. Iran plans to boost capacity to 45 million on the way to a target of 70 million.

Carriers in the Persian Gulf Arab countries dominate long-haul travel, thanks to smart, efficient hubs and a strategic position that places two-thirds of the world’s population within an optimal 4-8 hours’ flying time from Dubai, home to regional heavyweight Emirates.

The only serious regional competitor to these carriers for now is Turkish Airlines. But the variety of short- and long-haul jets acquired by Iran suggests it wants a share of the spoils in the future.

“(Iran Air’s) obvious intention is to become part of the network operation that the [Persian] Gulf carriers have operated so effectively,” said Peter Harbison, chairman of airline think tank CAPA.

“Iran is very well geographically positioned … We are obviously looking a few years out to get to that stage, but it is really where they need to be in 10 years’ time.”

Much also depends on how Iran regulates the new traffic, as the government negotiates new bilateral air traffic accords.

“They don’t want to fall in the trap that Air India got into,” CAPA’s Harbison says, referring to an influx of foreign capacity before the flag carrier was ready to compete.

The new Boeing and Airbus orders, alongside potential others from Brazil’s Embraer, Japan’s Mitsubishi Aircraft Corporation and Russia’s Sukhoi for which negotiations are underway, are part of Iran’s plans to add 400-500 planes in the next 10 years to upgrade and refurbish its domestic airlines.

Leave a Reply